The Registrar of Companies (ROC), part of the Ministry of Corporate Affairs (MCA), is the regulatory authority that awards Registration/Incorporation Certificates to Indian companies and LLPs and grants closure and oversees their administrative activities.

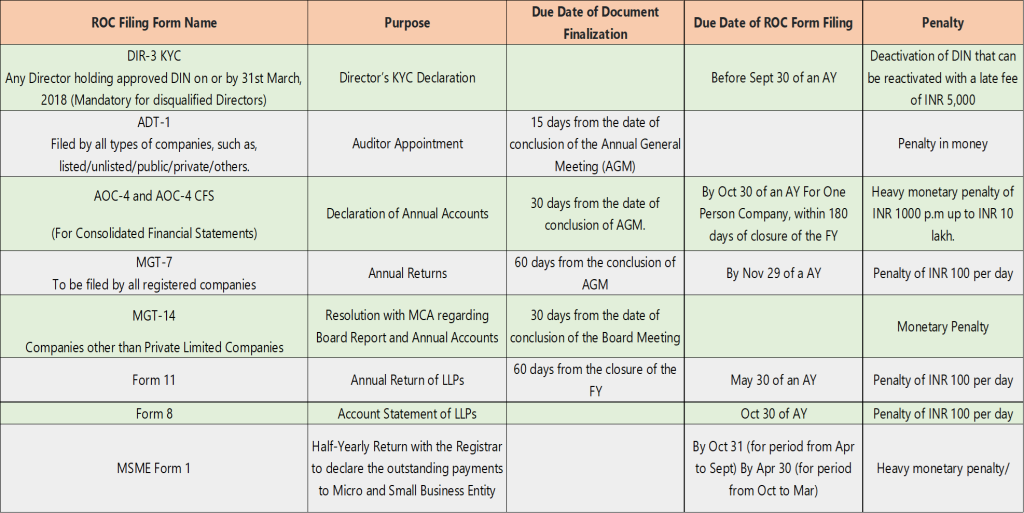

Companies and LLPs operating in India with registration issued under the Companies Act, 2013 and the Limited Liability Partnership Act, 2008, are required to comply with a detailed checklist of yearly submission or declaration filing procedures with the ROC within the prescribed deadline; failure to comply with the rules may result in heavy penalties under Indian law.

Regardless of an entity’s income, profit, or loss, businesses and LLPs must file their IT returns on time. The ROC is in charge of recording the following papers from registered companies and LLPs, giving permission or taking appropriate steps as needed:

Directors’ details, financial statements, board reports, annual returns, company resolutions (of any sort, taken), and other items finalized by the corporation in a scheduled Board Meeting.

ROC should accept Company Resolution (as per Section 117 of the Companies Act, 2013), Annual Account (as per Section 129(3), 137 of the Companies Act, 2013 read with Rule 12 of the Company (Accounts) Rules, 2014), and Annual Return (as per Section 92 of the Companies Act, 2013 read with Rule 11 of the Companies (Management and Administration) Rules, 2014) submissions within 30 (for Company Resolution and Annual Account submission) and 60 (for Annual Return submission) days of the conclusion made by the board.

The ROC shall examine whether the entity’s Financial Statements have been duly approved by the Shareholders and signed by at least the authorized Chairperson in the Meeting, as required by Section 134 of the Companies Act, 2013.

Accounting & investment boutique firm. Delivering quality since 2017

Copyright © 2023 Grow 360 Capital. All Rights Reserved. Designed & Developed By Swaget.

WhatsApp us